Determining the existence of a manipulation or bubble in the Small and Medium Enterprises (SME) segment requires a comprehensive analysis that goes beyond superficial metrics and speculative remarks. It is important to acknowledge the inherent risks associated with investing in the equity market, while also recognizing the potential for higher returns. Regulators play an important role in promoting a healthy investment environment that protects investors and promotes market stability. But the kind of panic situation that has arisen after the statement of the regulator casts doubt on the role.

Investing in the equity market inherently carries risks, a fact investors acknowledge when entering the arena. They seek superior returns compared to conventional fixed-income avenues, aiming to surpass inflation rates and augment their wealth. Diversification across different market segments, including large-cap, mid-cap, small-cap, and SMEs, can help to mitigate risks and potentially enhance returns.

Recent stress tests on small and mid-sized companies highlight concerns that regulators might not fully consider how markets react. While testing their ability to handle pressure is vital, it shouldn’t cause unnecessary worry in the market. A better approach could involve different stress test levels for various company sizes. Clear communication from regulators about the purpose and limitations of these tests would also help prevent misinterpretations. Remember, even large companies aren’t invincible. Past economic downturns showed that large-cap firms can also face similar challenges.

Data-Driven Analysis of a Bubble

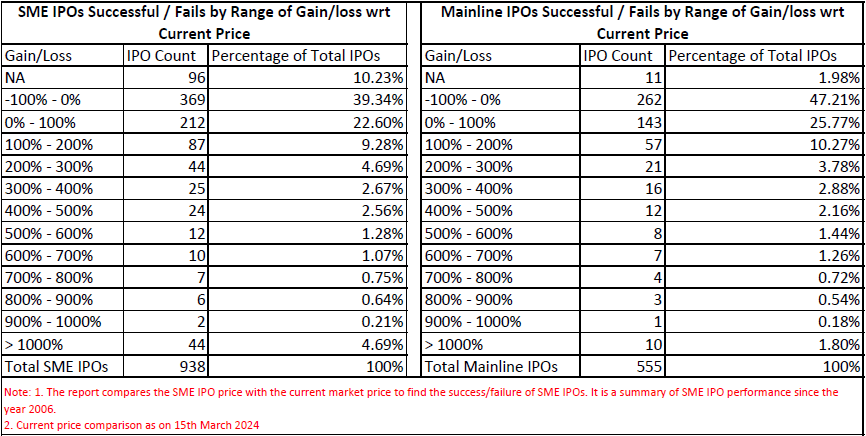

Identifying market bubbles warrants a comprehensive evaluation extending beyond superficial high returns in a particular segment. Scrutinizing the performance of SMEs vis-à-vis mainboard companies over time unveils nuanced trends. Notably, while SMEs have exhibited commendable performance in certain metrics, approximately 40% of SMEs and 47% of mainboard companies have registered negative returns, underscoring the intricate dynamics at play within the broader market landscape.

It’s also worth noting that among companies generating a over 100% return, approximately 28% are SMEs, while 25% are mainboard companies. This indicates that exceptional performance is not confined to a specific segment, further emphasizing the need for a holistic evaluation approach.

Of particular interest is the migration trend, with around 34.22% of SMEs transitioning to the mainboard. 321 companies migrated to mainboard out of 938 companies get listed on the sme platform. This phenomenon signals latent growth potential and scalability within the SME realm. Considering the escalating number of SMEs opting for listing on the platform in recent years, this migration trajectory is poised to persist.

Conclusion

– Investors know the stock market has risks, but they aim for higher returns than savings accounts or fixed returns. Spreading investments across different company sizes (large, medium, small, SME) helps manage risk.

– Stress testing companies is important, but regulators shouldn’t cause panic. This test should also be done on bigger companies to get a clearer picture.

– Just because some small businesses see high returns, it doesn’t mean a bubble is forming. We need to compare their performance to established companies over time.

– Many small businesses actually move to a bigger market (34%!), showing their potential for growth. With more companies joining the small business market, this trend is likely to continue.

In conclusion, figuring out if there’s a bubble in small businesses requires a thorough look, not just focusing on high returns. Regulators should aim to create a safe investment environment where investors are protected and the market grows steadily.