In recent years, India’s investment landscape has witnessed a significant shift as investors seek alternatives to traditional investment options like stocks and bonds. Alternative Investment Funds (AIFs) have emerged as a popular choice, offering diversification, professional management, and access to unconventional assets. In this comprehensive guide, we’ll delve into the world of AIFs in India, exploring their types, strategies, benefits, and regulatory framework.

Alternative Investment Funds (AIFs) in India

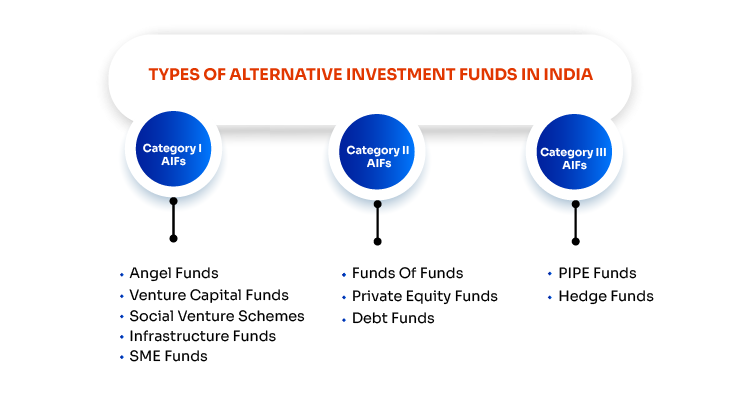

AIFs are pooled investment vehicles that invest in a range of asset classes beyond traditional investments. They are regulated by the Securities and Exchange Board of India (SEBI) and categorized into three main categories:

Category I AIFs

These funds invest the corpus in early-stage small and medium enterprises or SMEs, startups, and new corporations that are economically viable and have significant growth potential. Their subcategories are as follows:

- Angel Funds:

Such AIFs typically invest in new companies or startups that cannot raise funds from venture capitalists. - Venture Capital Funds:

These funds mainly invest in emerging businesses and startups with high growth potential and require substantial capital. One with a high-risk appetite and an aim to generate maximum portfolio returns often allocates money to such schemes. - Social Venture Schemes:

These AIF schemes invest in organizations participating in philanthropic activities. - Infrastructure Funds:

Such funds primarily invest in infrastructure projects. - SME funds:

SME funds in India, classified as Category I AIF, channel investments into small and medium enterprises in sectors such as water, railways, renewable energy, and waste management, fostering sustainable growth and long-term wealth creation.

Category II AIFs

According to SEBI, category II AIFs are funds that are not part of categories I and III and that do not opt for borrowing and leverage other than to fulfill day-to-day requirements.

The subcategories of Category II are as follows:

- Funds Of Funds:

These AIF schemes allocate their funds to other AIFs. - Private Equity Funds:

These funds use the accumulated money to invest in unlisted private companies that are challenging to raise capital by issuing equity and debt instruments. - Debt Funds:

This type of AIF invests in fixed-income securities of unlisted or listed invested companies that follow decent government models and possess good growth potential.

Category III AIFs

Category III alternative investment funds use various trading techniques and leverage by allocating their corpus to unlisted and listed derivatives. These AIFs can be open-ended or close-ended. Let us look at their different types.

The different types of category III AIFs are as follows:

- Private Investment In Public Equity Fund:

These AIFs invest in public firms by purchasing their shares at a discounted price. - Hedge Funds:

Hedge funds accumulate funds from corporations and investors to invest in equity and debt markets both on international and domestic levels. Such schemes use a high-risk investment strategy to generate returns for the investors. Hence, such funds are suitable for investors with a high-risk appetite.

Investment Strategies and Objectives

AIFs in India come with varying risk-return profiles, investment sectors, and liquidity profiles:

- Risk and Return Profiles:

AIFs offer a spectrum of risk and return options, from high-risk, high-reward strategies (e.g., venture capital) to more conservative approaches (e.g., debt funds). - Investment Sectors:

AIFs can target a wide range of sectors, including technology, healthcare, infrastructure, and real estate, allowing investors to diversify their portfolios. - Liquidity Profiles:

Some AIFs offer high liquidity, allowing investors to redeem their units at regular intervals, while others have longer lock-in periods.

Who Can Invest in an AIF?

Investors willing to diversify their portfolio can invest in AIFs if they meet the following eligibility criteria:

- Resident Indians, NRIs, and foreign nationals can invest in these funds.

- The minimum investment limit is Rs. 1 crore for investors, whereas the minimum investment amount for directors, employees, and fund managers is Rs. 25 lakh.

- AIFs come with a minimum lock-in period of three years.

- The number of investors in every scheme is restricted to 1000, except angel funds, where the number of investors goes up to 49.

Benefits of AIFs in India

AIFs offer several advantages to investors:

- Diversification Opportunities:

AIFs provide exposure to diverse asset classes, reducing portfolio risk. - Professional Management:

Experienced fund managers make investment decisions, enhancing the chances of generating attractive returns. - Access to Unconventional Assets:

AIFs enable investors to access assets like startups, private equity, and real estate, which may not be readily available in the public markets.

Comparison with Traditional Investments

Compared to traditional investments like stocks, bonds, and mutual funds, AIFs offer unique advantages:

- Equity and Fixed Income Investments:

AIFs provide an alternative to direct equity and fixed-income investments, offering more diversified strategies. - Mutual Funds:

Unlike mutual funds, AIFs have fewer restrictions on their investment strategies and asset classes. - Real Estate Investment:

Real estate AIFs offer a more structured and diversified approach to real estate investment compared to direct property ownership.

Future Outlook

The AIF industry in India is poised for growth, driven by emerging trends such as sustainable investing, technology-focused funds, and innovative strategies. Additionally, policy developments and regulatory changes will continue to shape the industry’s landscape.

Conclusion

Alternative Investment Funds in India represent an exciting and dynamic avenue for investors seeking diversification and unique investment opportunities. With a range of strategies and risk profiles, AIFs can be tailored to suit various investment objectives. However, it’s crucial for investors to understand the specific characteristics and risks associated with each AIF category before making investment decisions. As the AIF industry evolves and matures, staying informed and vigilant will be key to achieving success in this dynamic space.

Alternative investment funds are great for investors seeking higher returns and diversified portfolio. However, for making an informed investment decision, it is essential to carefully evaluate and select AIFs that unlock new growth opportunities.

To conclude, a wise investor must collaborate with a reputable SME investment expert who can help you with smart investments.

Chanakya Opportunities Fund is a trusted investment partner for investors. We offer a curated portfolio of high-potential SMEs selected based on their growth possibilities and profitability.

Secure SME investments with Chanakya Opportunities AIF Fund today.